The idea that society is divided into two major groups under capitalism: Working class (or proletarian) and Capitalist class (or bourgeoisie) has been out of favour for quite a while.

The idea that society is divided into two major groups under capitalism: Working class (or proletarian) and Capitalist class (or bourgeoisie) has been out of favour for quite a while.

There are many more common interpretations of what the import groups in society are. If asked most people would come up with a whole host of important classes:professionals, middle class, skilled workers, public/private sector etc.

There have also been many attempts to talk about social class which see it as a continuum. This idea that social class is simply where everyone has varying social power and so no firm divisions should be drawn. This sort of continuum hypothesis of social strata is given renewed vigour with the substantial and important work of Piketty1 who looks at the effect of wealth on society empirically over long time scales.

However, there are good reasons to avoid being too hasty, and removing class analysis from the picture. For a start, Marx’s two class model can give us tremendous insights into empirical data. However, perhaps more importantly, if it is true, it sheds enormous light on what we should do about inequality and a host of other economic problems which are present in capitalism.

The Idea of Class

Two class analysis precedes Marx. Thomas Hodgskin wrote about the conflict present between labour and capital as early as 18252. However, the most expansive and sophisticated descriptions of class have come from the developments made by Marx in Capital and the vast amount of subsequent work which followed on the back of this text.

The basic idea as described in Capital is that there are two main modes of obtaining money. The first is by wages, where you sell your labour power to an employer who is attempting to produce some commodity for sale on the market. The second is by utilisation of capital, where you utilise capital that you have accumulated to employ it in production with the hope of getting profits.

The vast majority of people have most of their income coming from wages. A very small number, (somewhere around .1%) have most of their income coming from investments. There are of course those that have income coming from both – for instance those who are wage labourers but also have investments in retirement funds, properties for rental, stock options etc. However, this generally does not constitute a significant percentage of income for the vast majority, and at any rate the dynamics do not change substantially simply because of the multiple roles that can be fulfilled by any given individual.

Bi-modal distributions and Class

This model of class has served socialists as the most important analytic tool for the socialist movement. Since its inception there was antagonism to the interpretation, but somewhere between the 1980s and the present day the notion of class as a fundamentally important aspect of the economy has been attacked by both the right and the left until it has become a less embraced explanation in almost all intellectual circles.

The most important arguments against class analysis can be summarised as follows:

a) People don’t identify as working class, and therefore it’s a meaningless category.

b) Other antagonisms in society are more important – those that have to do with skilled versus unskilled, private sector versus public sector, racial advantage, gender advantage, or any other relative advantage as a subgroup.

c) There really is simply a continuum of incomes and therefore the notion of class is a useless over-simplification.

Argument (a) may have some import in terms of public messaging, but is a really fantastically stupid argument from the point of view of analysis. Most people do not know about Maxwell’s field equations, but it would be preposterous to claim that this makes them useless for the analysis of Electro-Magnetism. If we are interested in scientific analysis of the structure of political economy rather than simply how to manage our public relations then we can directly ignore (a) as relevant to our analysis.

Argument (b) is one that is very often used by the left. The idea that all antagonisms in society would be overcome by merely overcoming the economic is of course absurd. However, our lack of control over economic resources means that anything we hope to achieve which is not compatible with capitalism will be deeply disadvantaged. As an example, we can take the struggle for gender equality. In advanced western democracies women have equal rights under the law – a fact which is not antagonistic with capitalism. However, the fact that the childcare is borne disproportionately by women means that there is a difficulty in reconciling full material equality of women with men within capitalism. It may of course be possible to achieve social democratic reforms which eliminate this particular problem, but doing so would be a class based economic demand requiring redistribution of incomes, and therefore class power, to do so.

While (b) may or may not be true in varying measures for different analyses, it doesn’t really help us understand class structure itself, or give any reason why we shouldn’t approach a detailed analysis of class. More on this question is written in my article Working Class Hero.

Argument (c) is probably the most important of the arguments. It’s been argued since the famous sociologist, Weber and before, and forms the most common notions of sociological class which is taught in universities. It is present in the popular notion of a middle class and it also happens to be very close to the sort of story that Piketty and other social democratic progressives see as the issue, and lends itself well to the notion that progressive taxation is among the most important amelioratives.

It is this third argument which we will be most concerned with, and which can be shown to be a poor analytic lens as compared to the more traditional analysis on empirical grounds.

Empiricism and Class analysis

A. A. Dragulescu and V. M. Yakovenko3, in a number of works, have looked at the statistical distributions of incomes in the United States, and subsequently, analysis in the same vein has been undertaken for the UK and Australia.

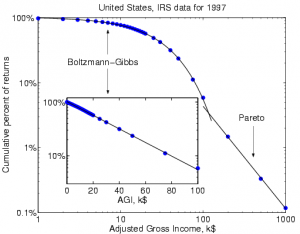

The basic result can be summed up in the following graph which demonstrates the distribution of income by showing the fraction having an income greater than some number X.

The important point of the graph is that the distribution is what is known as bi-modal. There are two different distributions which are giving rise to the distribution here and a fairly clear turning point.

When one has a bi-modal distribution in physics, we have a strong hint that there are two processes which are giving rise to the observed data. Here, likewise we should be thinking, what in particular might give rise to this dislocation between the distribution of incomes at the top, and those at the bottom.

From Yakovenko et al.

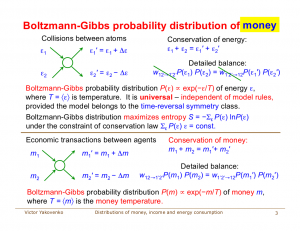

As it turns out the distribution for the lower incomes is known as a Gibbs distribution. This statistical distribution happens to have been studied very extensively in statistical physics and so we know a lot about what types of process give rise to the behaviour.

The Gibbs is common with random additive processes. A good example in nature is the distribution of energies in a gas at a given temperature. The additive process is the collision between molecules which transports some of the energy from one particle to the other.

The Marxist economist Kalecki4 was among the first who recognised that income would also follow such a distribution. He argued that the distribution of incomes of the working class was not log normal distributed. This alternative would come from a very different underlying process which is multiplicative).

If we think of what type of process might be giving rise to the income distributions in the working class here, one simple model is that people have monetary transfers amongst themselves which are effectively random. This process type of random particle-to-particle transaction is what is known as memoryless. Each event between the individuals taking part is essentially an isolated random event, like the toss of the dice, with no dependence on the past behaviour.

It is really only such random memoryless additive type processes which can lead to Gibbs distributed variables. This memoryless character really calls into question the idea that our economic system is based on meritocracy. How could it possibly be if it is so well modelled by randomness without any memory of past actions?

From Yakovenko et al.

Of course, that doesn’t mean that everyone is the same – people starting with a higher quantity of money are more likely after some time to have more money than those starting with a small amount, very much as how the velocity of a particle in the gas is more likely to be high after some time if it started high. But on the whole, in aggregate, the dynamics work out to be effectively random transfers.

It is also quite possible that there is “more than one type of molecule” in the gas. There may be some types of molecules which have properties of being able to take on higher amounts of money than others (for instance, we might think of race) – but the transfers are still going to be random and additive in nature.

But what is going on in the upper income tail and what type of process is likely to lead to it?

The Capitalists

The distribution at the high end of the scale is what is known as a power-law distribution, or more often when speaking of wealth, the Pareto distribution (Pareto was a fascist sympathiser and mathematician who was studying income distributions).

This different distribution points to the fact that these people are getting their money in a process that doesn’t just involve additive transfers. There are several different possible methods of obtaining power-law distributions, but one important method is a process with memory.

A typical way of obtaining the dynamics is from a process which is dependent on the former state. In mathematical terms it might be expressed as follows:

x(t+1) = x(t)c(t) + a(t)

This means that the amount of money at time t+1 (one time step into the future), is dependent on the current amount of money, times a multiplicative term, along with some additive kick.

For a moment we can go back to Marx’s description of the circuit of capital. He says that there is an essential process in the circuit of capital which applies to those who invest money with the intention of profit. This process is generally written as:

M → M + ΔM

However, we notice that this arrow is signalling that we are working with a time dependent process and we can rewrite it slightly as.

M(t+1) = M(t) + ΔM(t)

Now, this ΔM(t) term is actually an amount of money which is not independent of M(t), but is instead dependent on the previous total holding of capital and what is known as the profit rate. We can change our equation a bit to be the following:

M(t+1) = M(t)(1+r(t)) + c(t) where ΔM(t) = r(t)M(t) + c(t)

Basically what we are doing here is modelling the capitalists’ increase in funds on an expected profit rate (which vary well may itself depend on time) and some random factor which models risk in capitalist transactions – again, a kicking term. This rewriting shows that Marx’s notion of the circuit of capital could well be the underlying dynamics which give rise to the power law distribution of incomes.

This is quite different to the notion of wealth itself as being the important factor. In the Marxian analysis, one needs to employ capital in the process of attempting to make money before it leads to the process above. As an example, owning a house with a nominal value of one million, actually will not lead to the capitalist type dynamics at all, unless one is not living in it, but renting it out. Simply holding wealth is not what gives rise to the difference of kind. This is an example that really sets the Marxist notion of capital apart from, for instance, Piketty’s approach to wealth.

The Process Over Time

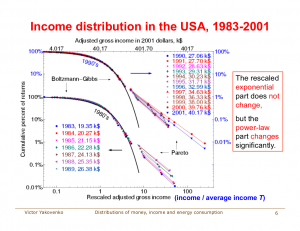

Dragulescu and Yakovenko carried out this analysis for several years and one of the most interesting facts is that while the income distribution amongst the lower class was exceptionally stable, remaining unchanged over years, the tail tended to shift quite a bit between years. This again lends credence to the idea that the rate of return is changing, leading to shifts in the distribution.

From Yakovenko et al.

Some Potential Results

There are some very interesting potential results if this underlying dynamics is true. In particular, it helps to join together Marxism’s rather impressionistic descriptions of crisis theory with an explanation similar to that given by Minsky.

It has been demonstrated that stock market transaction volumes are themselves power-law distributed. This means that there are Black Swan type events lurking in the market which can easily give rise to bubbles and consequent crises. Gabaix et al.5 point out that the power law distribution of capital amongst players in the market can directly give rise to such power-law distributions in market transaction volumes. Now that there is good empirical data of power law distributed holdings by capitalists due to Dragulescu and Yakovenko, the approach might open up a potentially new type of Marxist crisis theory.

Criticisms

There have been some suggestions that power law type behaviours simply do not occur in economics. A summary of many of these arguments and some refutations is given by Farmer and Geanakoplos6. But one powerful reason that it will tend to be rejected is that an equilibrium theory which has to cope with power law type behaviour is likely to be impossible, leading to some of the most favoured explanations about the efficiency of the market to fall flat on their face. This is a powerful disincentive to believe in such things to those economists who are wedded to the notion of market efficiency.

Conclusion

The bi-modal behaviour of the statistical distribution of incomes gives striking evidence that class is an empirical fact. Whereas in the past many of the arguments for and against resorted to sometimes impressionistic (which can often be a useful starting point), and sometimes Jesuitical arguments (on both sides), future arguments against the existence of a class basis in the economy are going to have to explain why the high income tail does not match with the rest of the income results of the population.

Further it will have to answer how a system which is well modelled by completely random transfers could really be based on meritocracy (which itself requires that the distribution have a strong memory).

But perhaps even more interestingly, it is not only the existence of economic classes which was predicted correctly by the historic socialist movements and most prominently by the Marxists. There is now strong evidence that the dynamics given by Marx in Capital are also correct. There is further the possibility of using these results to deepen Marx’s analysis and come up with useful models which could describe a host of the power-law behaviour that is known from empirical research in econometrics.

- Capital in the Twenty-First Century, Thomas Piketty, Aug 2013 ▲

- href=”https://www.marxists.org/reference/subject/economics/hodgskin/labour-defended.htm”>Labour defended against the claims of capital, Thomas Hodgskin ▲

- href=”http://physics.umd.edu/~yakovenk/econophysics/”>Statistical mechanics of money, A. A. Dragulescu and V. M. Yakovenko ▲

- Kalecki: Econometrica 13 (1945) 161 ▲

- X. Gabaix, P. Gopikrishnan, V. Plerou, and H. E. Stanley. A theory of power-law distributions in financial market fluctuations. Nature, 423:267–270, 2003. ▲

- Power laws in economics and elsewhere, J. Doyne Farmer and John Geanakoplos ▲

3 Responses to Is Class Real? Some Empirical Contributions from Econophysics